View billing transactions and lifecycle

Clover generates charges based on the merchant's app usage. Use the Billing — Transactions page on the Developer Dashboard to track these charges through the billing lifecycle. You can see statements with your disbursements on the Billing > Statements page.

TIP

When analyzing a charge, note the unique Charge ID on the transaction. Click the status to see the charge details.

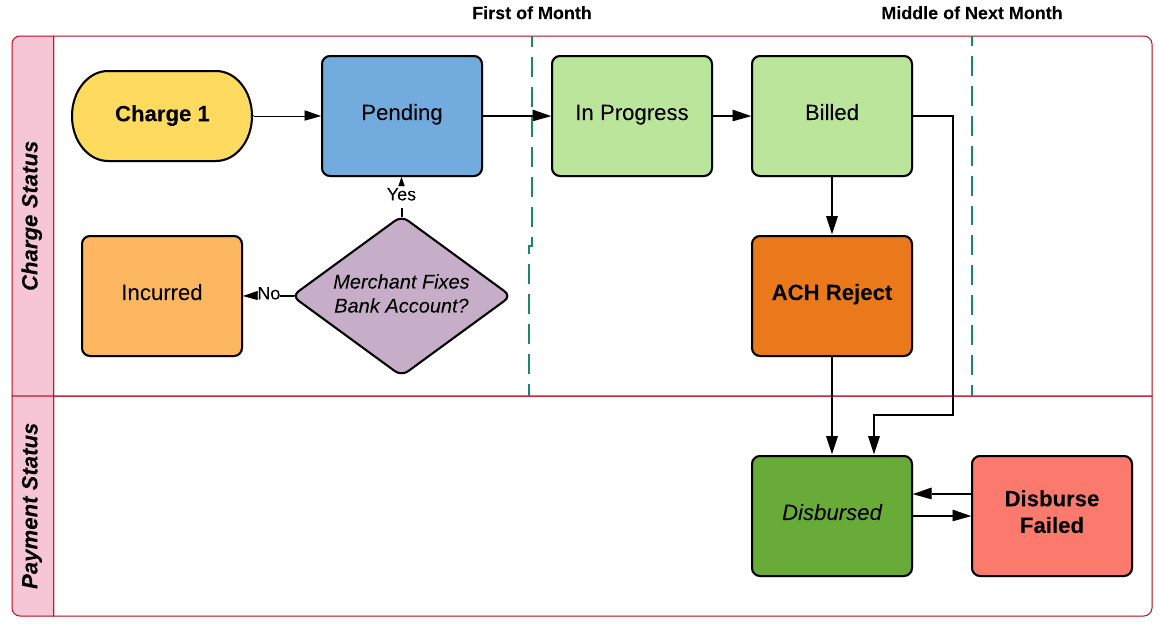

Billing lifecycle

The following figure displays the billing lifecycle.

Billing lifecycle flow that displays the happy path and the developer payment status.

Monthly payment workflow

Clover billing does the following:

- On the first of the month, bills in advance for subscriptions.

- Throughout the month, creates partial month charges for new installs.

- Throughout the month, creates prorated subscription charges/refunds for subscription changes and uninstalls.

- On the first of the month, bills for metered events are in arrears.

- On the first of the month, processing of the Pending charges begins and moves them to In Progress.

- Attempts to debit the merchant's bank account and changes the charge status to Billed.

- Deposits your share of the charge in the third week of the following month and sets the charge status to Disbursed.

- Sends you a confirmation email of deposited charges.

- If the deposit fails, the payment status changes to Disburse Failed. If you see this status, make sure your bank information is current with Clover.

IMPORTANT

In order for a disbursement to go through successfully, you must have a current and active bank account with Clover. If your bank account has changed update your bank account.

ACH reject charges

Clover billing does the following if a merchant fails to pay the amount due:

- Sets the rejected charges to the ACH Reject status.

- Sends an email to the merchant informing them of the rejection and asking the merchant to update their banking information.

In the North American region, if the merchant's bank account is not fixed after an ACH reject, the charges from the next month's transactions are set in the Incurred charge status. Clover Billing:

- Sets all existing pending charges or refunds to the Incurred status.

- Sets all subsequent charges or refunds to Incurred.

- The subsequent monthly statement email will remind the merchant to update their banking information and include the outstanding balance of Incurred charges.

You won't be paid for the Incurred charges until the merchant has fixed their bank account with Clover, and Clover can collect the amount from the merchant.

In the European region, charges after ACH reject remain in the In Progress status until the merchant fixes their bank account or Clover deactivates merchants who have not been paying over a long period.

NOTE

While the merchant is in a Lapsed account status you can still request refunds for Incurred charges.

After the merchant has updated their banking information, Clover will:

- Change the Incurred charge statuses to Pending.

- Process the Pending charges on the 1st of the next month.

You can contact the merchants whose charges are in the ACH Reject charge status and ask them to update their bank information. Merchants can update their bank information by calling the Clover Customer Service number on their statement. Merchants must state they want to update their App Market bank account or direct deposit account (DDA).

Alternatively, you can handle this scenario within your app. Clover Developer Agreement recommends this as your responsibility in Part 1, section 8.5.

Reasons for ACH reject

Because Clover serves small and medium businesses, we expect occasional issues with merchants paying Clover on time. Reattempts to debit the accounts are based on the ACH processor rules in each region.

Some of the reasons why payments to Clover fail include:

- Insufficient funds

NOTE

In North America (NA) region, Clover reattempts to debit the account twice totally. If the reattempt to debit the merchant account fails again, those charges are again set to the ACH reject status. This merchant's account status is changed to Lapsed.

- Account was closed or doesn't exist

- Invalid bank account number or account incorrectly set up

- Payment stopped

- Bank account frozen

- Merchant goes out of business

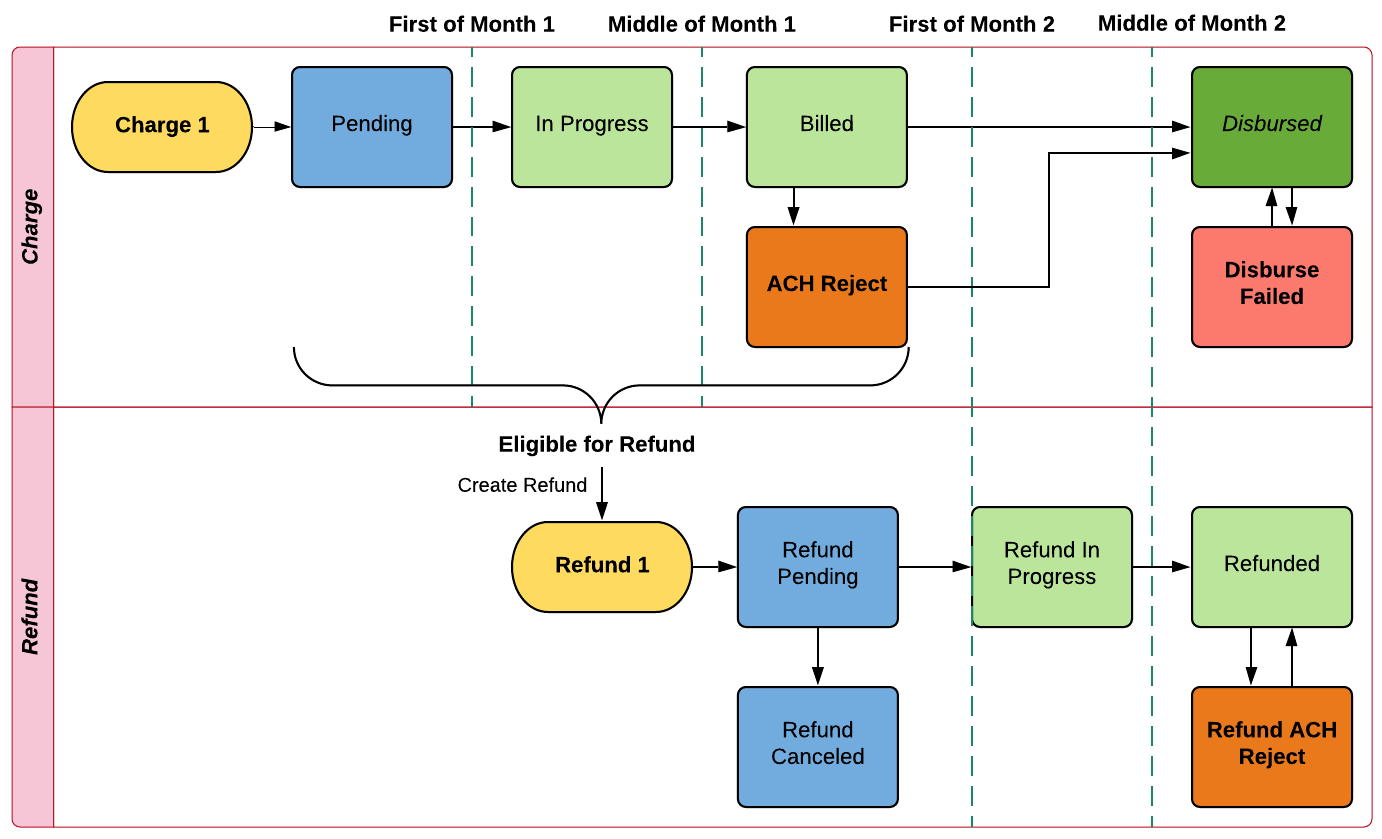

Process refunds

You can issue a refund directly from the Developer Dashboard for duplicate or incorrect charges. Other refund cases include a subscription plan change or a merchant's request for a full refund.

Refunds workflow

Refund scenarios for merchant downgrade, app uninstall, ACH reject, and incurred charges.

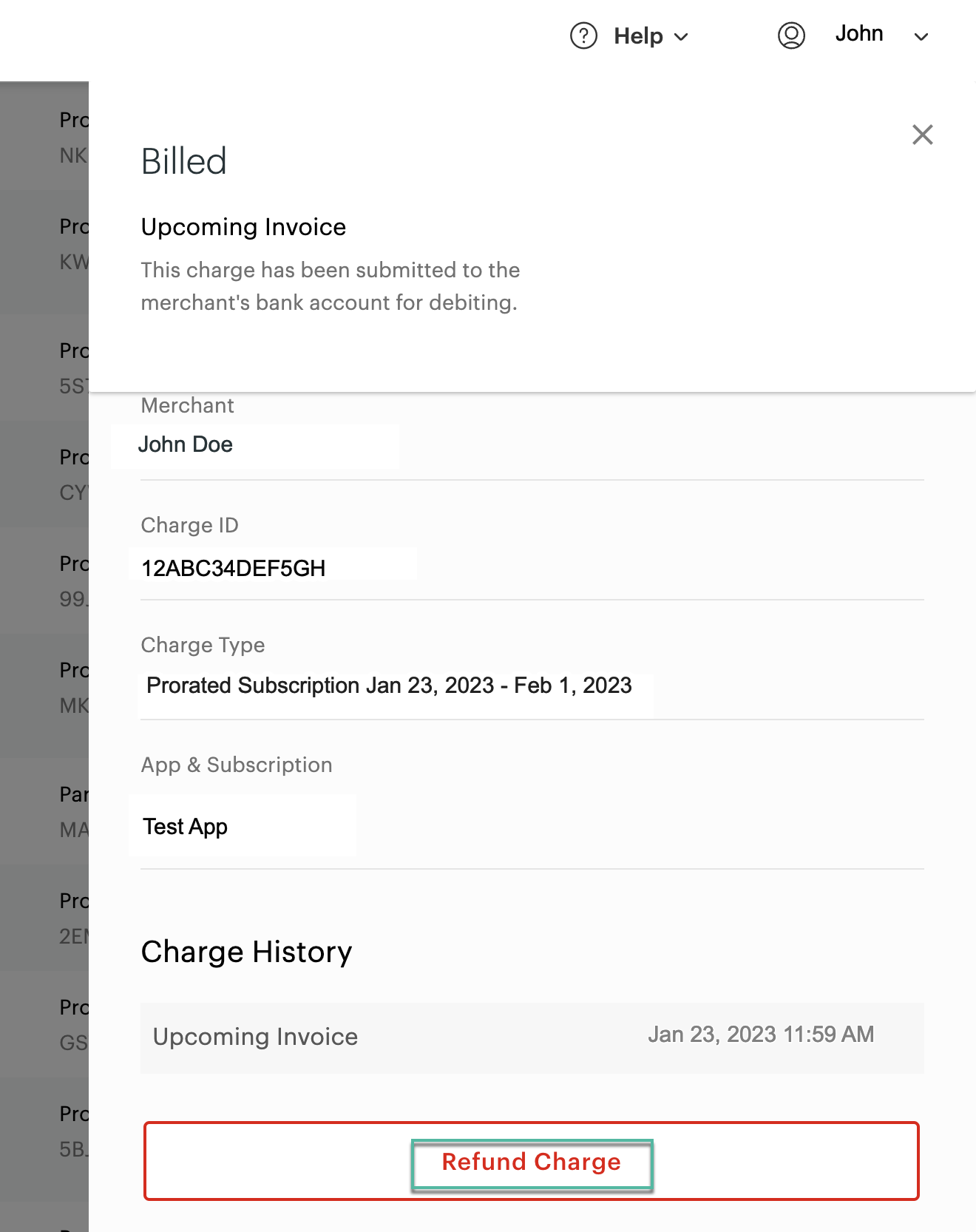

Issue refunds for duplicate or incorrect charges

You can refund duplicate or incorrect charges if they are in Pending, Incurred, In Progress, or Billed status. You cannot initiate refunds from the Developer Dashboard when charges are in the Disbursed status. Contact the Clover Developer Relations (DevRel) team at [email protected] to discuss options for refunding disbursed charges.

- Log in to your Developer Dashboard.

- From the left navigation menu, click Billing > Transactions. The Billing - Transactions page appears.

- Click the transaction status to issue a refund. The slide-out panel displays the transaction status details, charge summary, charge history, and Refund Charge button.

Note: The Refund Charge button appears only if the charge meets the previously mentioned criteria for a refund.

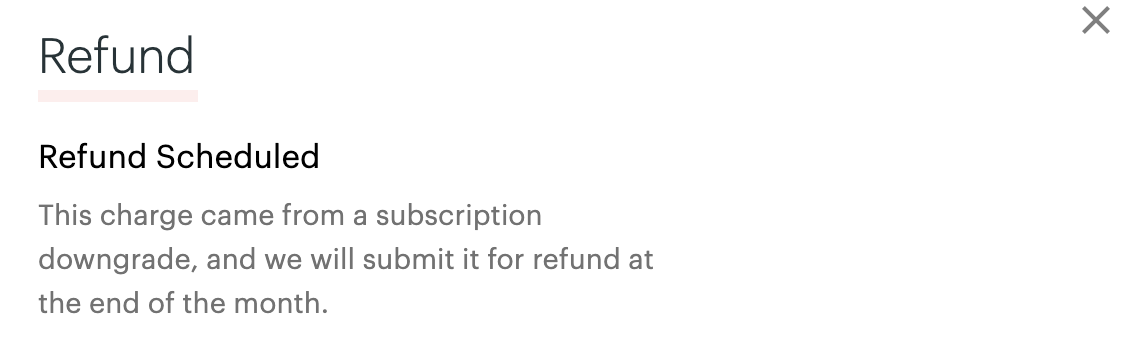

- Click Refund Charge. The Charge History section displays the following:

- A new row—Refund Scheduled—and transaction status is changed to Refund.

- Once the Refund is successful, a new row—Refunded—is added for the same transaction.

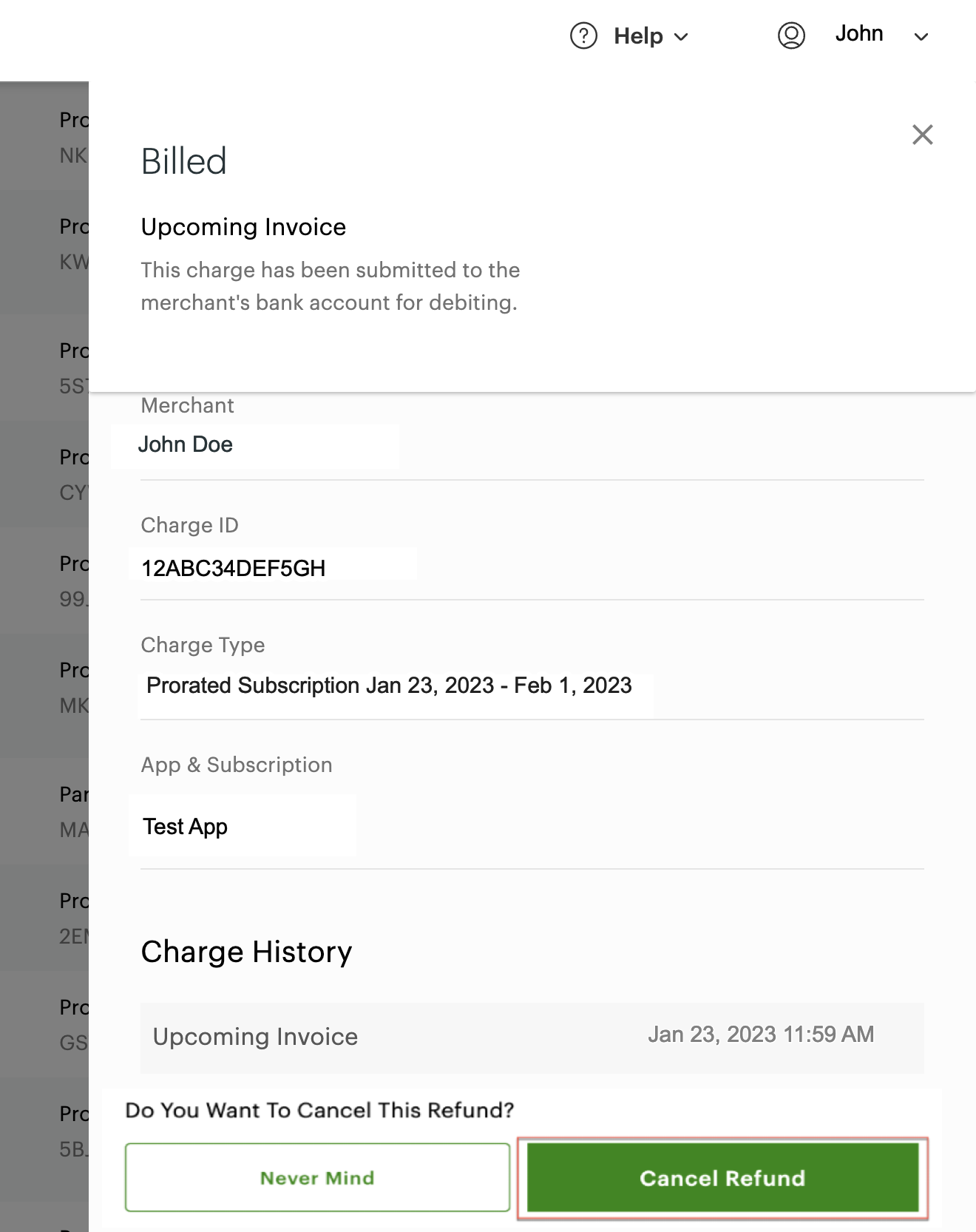

Cancel scheduled Refund

You can cancel refunds for transactions in the Refund status. See Issue Refunds for duplicate or incorrect charges.

- Log in to your Developer Dashboard.

- From the left navigation menu, click Billing > Transactions. The Billing - Transactions page appears.

- Click the Refund status next to the transaction to cancel the Refund. The slide-out panel displays the transaction status details, charge summary, charge history, and Cancel Refund button.

- Click Cancel Refund. Once the Refund is canceled:

- The charge status changes to Refund canceled.

- A new row—Refund canceled—is added under the Charge History section.

Refunds for subscription upgrades and downgrades

When a merchant changes subscription tiers or uninstalls an app, Clover creates a new Refund downgrade pending charge and adjusts the prorated amount in the next billing cycle. Once the Refund is complete, the Refund status displays on the Billing page on the Developer Dashboard. You can click the Refund status and view details in the slide-out panel.

Alternatively, you can handle this within your app. Clover Developer Agreement recommends this as your responsibility in Part 1, section 8.5.

Recieve monthly payments

You can view the amount Clover disbursed to you and the transactions in various statuses in the Billing section on the Developer Dashboard. View your monthly statements in the Statements section to see the exact charges to merchants and the amount disbursed to you.

The Billing section displays information on the amounts charged to merchants for your apps and the amounts disbursed to you.

Total Number of Charges: Total number of charges to billable merchants

Total Billable Merchants: Total number of billable merchants

The Statements section shows you the Total Charge and Disbursed amounts for a billing cycle. The disbursed amount is your share of the total charge to merchants. The amount will vary depending on refunds and delays with collecting amounts from merchants. For example, refunding a charge or a delay in collecting a charge from a merchant may cause that portion of your payment to roll over to the next month.

You can see the tax amount against each charge on your statement. See how order totals are calculated.

In the scenario that a merchant was ACH reject and accumulated incurred charges over a long period until the merchant reactivated their account, Clover debits the amount in the next month. Clover pays your share 45 days after they collect the amount from the merchant. However, if the amount to be collected exceeds the merchant's bank account balance, the transaction can be ACH reject again. So merchants must be aware that reactivating their account means they may have a large debit amount request from their bank in the following month.

Updated about 1 year ago